Part II of FDR and the Unfinished Agenda

by Chris White with AvaHome

for ePluribus Media

Editors’ Note: On September 30, 1934 FDR had his sixth fireside chat with the nation. When many of us feel that our nation is on the brink of a different type of disaster, FDR’s words hold hope and inspiration for us all.

Writer Chris White and researcher AvaHome have prepared a 5-part series looking at the FDR legacy, especially in light of the current administration’s disasterous record. The entire series is on the ePluribus Media Journal in the FDR and the Unfinished Agenda feature.

“(We have) Nothing to fear, but fear itself.”

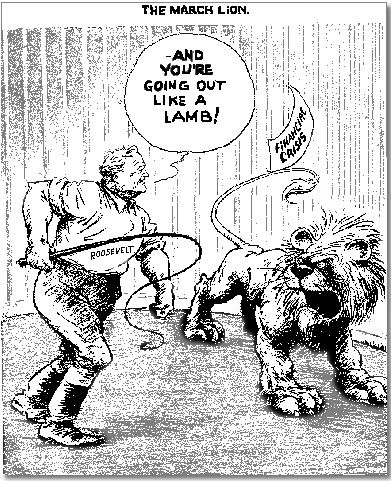

That tag line from FDR’s first Inaugural Speech lives on in the memory of the nation. There’s a lot more in there too, for the speech is an outline of what he intends to do as soon as he has the power to do it. Even at this moment, people are drawing up the orders he will issue to do it, he has told them to have them ready after the inauguration, for there is no time to spare as a national economic catastrophe bears down on the nation with the turbulent inevitability of a category 5 Hurricane making landfall.

The first gusts from this storm were already toppling trees; the day before Roosevelt spoke nearly $140 million dollars worth of gold had been withdrawn from the banks. The New York Stock Exchange and the Chicago Board of Trade had closed their doors indefinitely. Banks in 32 states were completely closed down, and in ten more states customers could only withdraw 5% of their deposits. The planned export of $9 million worth of gold aboard the French liner Paris had been aborted by Governor Lehman’s dawn shutdown of New York State’s banks.1 The country was flat-lined; there was no economic pulse.

“The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Happiness lies not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort. The joy and moral stimulation of work no longer must be forgotten in the mad chase of evanescent profits. These dark days will be worth all they cost us if they teach us that our true destiny is not to be ministered unto but to minister to ourselves and to our fellow men.

Recognition of the falsity of material wealth as the standard of success goes hand in hand with the abandonment of the false belief that public office and high political position are to be valued only by the standards of pride of place and personal profit; and there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing. Small wonder that confidence languishes, for it thrives only on honesty, on honor, on the sacredness of obligations, on faithful protection, on unselfish performance; without them it cannot live. Restoration calls, however, not for changes in ethics alone. This Nation asks for action, and action now. Our greatest primary task is to put people to work…”2. (FDR’s Inaugural)

Even as Roosevelt spoke, aides drew up the legal documents, proclamations, and legislative proposals that formed the core of the New Deal, his economic recovery program to put the nation’s banking system back on a sound basis. A day-by-day account of some of this process is available in the appended timeline.3 The officials who drafted these documents were members of the outgoing Hoover administration, as Roosevelt’s own appointees could not be sworn in until Congress reconvened. Some conclude from this that FDR was really implementing Hoover’s policy, as Hoover had been urging him to do. Fairy stories for children. What Roosevelt was about to do as he took the oath of office was different from anything his predecessor had either contemplated or attempted.

After attending church that morning at St. John’s Episcopal in Lafayette Square opposite the White House, FDR held a meeting at the Mayflower Hotel to finalize the plans. President Roosevelt planned to employ the Trading with the Enemy Act of 1917 to ban the withdrawal, export, hoarding etc. of gold and silver, and block foreign exchange transactions. He was going to declare under these emergency provisions a Bank Holiday that would last from the 6 March to 10 (a Friday). He was going to convene an emergency session of Congress to take up legislation to fix the banks, and authorize the issue of credit in the form of Treasury notes, not to be called that, as had been done before by Abraham Lincoln. He was going to meet with bankers from the east, to discuss what they could do too. That evening, and the next day, Sunday 5th March, everything proceeded smoothly.

Proclamation 2038 issued on March 6th called Congress back into Emergency Session.

Proclamation 2039 declared the Bank Holiday closure and reorganization of the banking system. FDR’s first press conference of March 8 provided his view of the situation in which he found himself.

Within two weeks the potential to turn the situation around had been established. Banks were reopening. $300 million worth of gold had been returned. There was a new mood in the country. FDR could report ongoing progress in his first "Fire Side Chat" which he gave March 12. (The chat) By the end of the month banks representing around 90% of all deposits were open for business again.

What had been proven during those first two weeks was that the power of money is not everything. This is a lesson that could be learned again today. This is written on the first anniversary of the devastating hurricane Katrina. The event is commemorated in many ways, and what contribution does the Bush administration claim to have made to the regional and local recovery effort? Money! They are providing $60 billion. More money than has ever been provided for reversing the effects of civil disaster. And a year later, when the unemployed should have been put back to work, building, cleaning, fixing, when businesses should have been helped get back on their feet, how does it look then? $60 billion without the addition of human initiative and energy does not do much on its own. Money may talk as the saying goes, but it does not provide leadership. Unlike Bush, FDR knew what has to be done to make money ‘walk’.

The Katrina example is an example of what used to be called “trickle down” economics. Proponents of “trickle-down” economic policies believe that giving money to the wealthy and to powerful corporations helps the unemployed, as the spending indirectly produces jobs and economic growth. They contend that rather than directly providing jobs or investing in infrastructure, the government should give tax cuts and subsidies to the rich in the hope their spending sprees will create jobs. Roosevelt’s predecessor Herbert Hoover believed in Trickle down economics.

Hoover believed the cause of the US depression lay in an international financial and monetary crisis caused by the collapse of the post World War I reparations payment system in a wave of defaults between in 1931 and 1932. In his heart, Hoover knew he was not to blame, personally, individually, politically, economically, or any other way. It was the international system, you see. FDR had nothing but contempt for that view which he considered an absolute evasion.

Hoover believed the cause of the US depression lay in an international financial and monetary crisis caused by the collapse of the post World War I reparations payment system in a wave of defaults between in 1931 and 1932. In his heart, Hoover knew he was not to blame, personally, individually, politically, economically, or any other way. It was the international system, you see. FDR had nothing but contempt for that view which he considered an absolute evasion.

Hoover did many things to try to counter what he thought the causes were. None of them worked. First there was the “trickle down” approach. There was the collateralization of real estate secured debt, both agricultural and housing debt; which didn’t succeed. And there was volunteerism. He attacked FDR for spreading fear and alarm, which was causing problems for the economic recovery he had organized.

These attacks continued after the election perhaps more aggressively than they had during the campaign, as Hoover attempted to convince, trap or trick FDR into endorsing policies that had just been rejected massively by the electorate. This activity is documented in the timeline attached and it continued down to the last hours before FDR’s Inauguration. Hoover even called FDR twice on the eve of his swearing in, urging him to commit to Hoover proposals.

But Hoover’s ideology and policies had proven disastrous. Under Hoover, unemployment and its effects were one of the issues thought best to be left to volunteer agencies and charity, not fit to be the work of government. One of the effects of this was an acceleration of the banking collapse, as immigrant ethnic groups ran down deposits in community banks and mutual societies to help the stricken. This devastated communities in Chicago, but Chicago was not alone.

On the trickle down front, in January of 1932, as FDR was announcing his decision to run for office, Hoover was having Congress create the Reconstruction Finance Corporation.4 This agency was capitalized with $500 million and empowered to borrow $1.5 billion, in order to provide funds to worthy banks so the banks could pass those funds out into the broader economy. It didn’t work. By the end of the year, and the first months of 1933, Senate Banking Committee hearings were scandalizing the RFC for its cronyism. As reported in part 1, the RFC’s largest loan, $90 million, was made on Hoover’s personal ok to the Chicago bank of his friend Charles G. Dawes, Central Republic Bank. Another beneficiary was the National City Bank of New York.

Little of this money trickled down to the millions of unemployed Americans who needed help most. Like Bush’s trickle-down tax cuts for the rich, and Katrina-recovery spending, these programs enriched administration cronies while harming large numbers of Americans with their counter-productive consequences.

In Feb of 1932 the Glass-Steagall Act attempted to redefine mortgage debt into collateral for further loans, and then expanded creation of liquidity. An attempt was made to do the same through Federal Home Loan Banks. We do a similar thing now. The experts call them collateralized mortgage obligations. Individuals’ mortgages are packaged and passed on to others, and become one of the components of a derivatives market, where one person’s liabilities added to others, become another person’s assets, and supposedly provide ‘hedges’ against financial Armageddon from which we are all thought to benefit by way of guaranteed financial stability.

It is amazing today to contemplate the views espoused by those who argue that what Roosevelt accomplished in these first few weeks of his presidency was like a charming exercise in making people feel happy, a mood change. It is true that the mood of the country changed. In the wake of his Inaugural speech, and the actions begun in its aftermath that first weekend in March, the White House received nearly half a million letters from individual Americans. No president before Roosevelt had received more than 200 letters per day, including Herbert Hoover. Seventy work places were created in the White house to handle the increased volume. It was clear that over the first weekend of his Presidency Roosevelt had done much more than change the mood; he had struck a powerful chord in the hearts of those who he took to be his constituency, as he provided leadership against Hoover’s cronyism and failures. And they would be prepared to follow him as he organized their support.5

Post Election Timeline

November 8th 1932:

Hoover FDR exchange telegramsNovember 9th: Hoover FDR exchange telegrams Mid November Hoover letter on debt, telling FDR of a British government

review, threatened British Dec 15th defaultNovember 22nd: WH Meeting, Hoover and Ogden Mills, Treasury Secretary, FDR and Moley. Hoover lectures for an hour on debt. Asks Roosevelt to support formation of a commission which has already been killed in Congress. British pay what Hoover said they weren’t going to.

December 17th: Hoover telegram to FDR proposing “machinery” be created to deal with French default. Hoover wants to combine debt and disarmament negotiations. Would advise Congress. Does Roosevelt agree?

December 18th: Hoover advises Congress

December 19th: FDR replies: he doubts the wisdom of combining debt and disarmament, asks Hoover not to tie incoming administration

December 20th: Asserting that the international crisis requires cooperation between him and FDR Hoover asks FDR to name a representative to coordinate with his administration.

December 22nd: Hoover releases the correspondence to the public, before FDR can reply. FDR happy to cooperate as much as possible in exploratory discussions.

Late December FDR opposes Hoover’s proposed tax increases for the next year’s budget, and floats idea of parallel “investment” budget.

January 9th: 1933 FDR lunches with Hoover’s Secretary of State Henry Stimson at Hyde Park.

January 10th: FDR meets French Ambassador Claudel, tells story of the non-payment history of France’s 1777 loan to the US. Says word “default” must never be used among friends.

January 18th: FDR meets Tugwell and Moley in New York to discuss international crisis.

January 20th: FDR and Hoover at the White House to discuss debt and disarmament again.

January 30th: Hindenburg clears way for Hitler

Early February Huey Long closes Louisiana banks. (Anniversary of WWI break with Germany?)

February 3rd: FDR leaves Palm Springs for Florida cruise.

February 14th: Governor William Comstock of Michigan closes state banks for 8 days after Henry Ford refuses to agree to RFC terms for aid.

February 15th: FDR arrives in Miami. Zangara assassination attempt. Cermak, Mayor of Chicago fatally shot, others wounded in incident in front of 20,000. Zangara had article about McKinley assassination in his pocket.

After the assassination attempt, but before the end of the month, Tugwell contacts Feis at State to tell him FDR wants research done on legal basis for Woodrow Wilson’s blocking of gold exports in 1917. Feis got the Trading with the Enemy Act of 1917 out of Treasury, which tells people in Congress, gave the results to Tugwell, who took them to FDR at Hyde Park.

February 17th: Hoover sends 10 page, handwritten letter to FDR via the secret service. Tells FDR a “state of alarm” threatens the economic recovery. Says FDR needs to commit a balanced budget and defense of the gold standard. FDR ignores the letter.

February 20th: Hoover tells Senator David Reid of national concerns about what FDR might do for stability. Says Roosevelt must endorse Hoover policies.

February 23rd: George L. Harrison, President of the Federal Reserve Bank of New York reports to fellow members that withdrawals of gold are heavier than in any period. “Our own people were beginning to act badly to gold exports and the declining value of the dollar.”

March 1st: FDR replies to another letter, and says his secretary neglected to send the draft of the reply to the February 17th letter

March 2nd: By this date more than half the states had closed their banks, and $200 million dollars worth of gold had been pulled out of the banking system.

March 3rd: $110 million worth of gold paid out to foreign banks in New York and Chicago. $40 million worth paid out by other banks. New York Stock Exchange and Chicago Board of Trade closed. Roosevelt travels to DC. Afternoon tea at the White House, Hoover brings in Mills and Eugene Meyer from the Federal Reserve for another round of arm-twisting. Roosevelt says “it is your problem till midday tomorrow.” That evening Hoover phoned twice to get Roosevelt to agree to restrict bank withdrawals and gold exports. Woodin and Moley went over to Treasury to begin work on the FDR bank holiday initiative. By the end of the day 32 states had closed all banks. In 10 more and the Federal District withdrawals had been limited to 5% of deposits.

The Trading With the Enemy Act Revived. “The President may investigate, regulate or prohibit, under such rules and regulations as he may proscribe by means of licensure or otherwise, any transaction in foreign exchange and the export, hoarding, melting, or ear-marking of gold or silver bullion or currency.

March 4th: At dawn, the governors of New York State, Pennsylvania and Illinois sign orders closing banks indefinitely. Space booked on the French liner Paris to ship $9 million in gold out of the country. $6 million frozen by Governor Lehman’s moratorium. $3 million had been loaded over night. According to Barrons of March 13th “Arrangements for further shipments of even greater quantities were said to be underway when Governor Lehman’s edict halted the outflow of the metal.”

34 out of 48 states have closed their banks. The country had no economic pulse.

Woodin and Moley meet FDR at the Mayflower to discuss measures and recommend he use the Trading with the Enemy Act used by Wilson in 1917 to stop gold exports, call Emergency Session of Congress for the 9th, Roosevelt wanted enabling legislation drawn up and ready for signature when he returned from the Inauguration. Calls in bankers from east coast and as far west as Chicago for meeting on Sunday 5th to discuss the legislation.

March 5th: Proclamation 2038 calling on Congress to convene in Special Session beginning March 9th. Meeting between FDR and tem ad bankers. Radio broadcast to American Legion relayed nationally by networks. Proclaim banks closed till 10th. Prohibit gold export and foreign exchange transactions.

March 6th: Proclamation 2039 indicating what kind of emergency powers FDR thought he needed.

March 7th: Secretary of the Treasury authorized clearing banks to issue demand certificates against sound assets, effective March 10th.

March 8th: Roosevelt’s plan to get the gold back launched. The Federal Reserve announced it would publish the names of all those individuals who had withdrawn gold after February 1st and not re-deposited by March 13th.

First of FDR’s 998 press conferences at the White House. Two per week to start with.

March 9th: Passage of Emergency Banking Act, by voice vote in the House, 73–7 in the Senate. Gives Executive branch power to extend credit against deposit of Treasury debt. “[A]ny Federal Reserve Bank making such deposit in the manner prescribed by the Secretary of the Treasury shall be entitled to receive from the Comptroller of the Currency circulating notes in blank, duly registered and countersigned.” Forbids member banks of the Federal Reserve System from transacting banking business except under regulations of the Secretary of the Treasury, during an emergency proclaimed by the President. (!2 USC 95)

March 10th: 4,000 have brought back $300 million worth of gold to NY banks.

March 12th: FDR’s first Fireside chat, on measures to bring the banking crisis under control.

March 13th: The 12 Federal Reserve district cities re-open.

March 14th: All banks found sound in cities where there are clearing banks reopen.

By the end of March banks holding 90% of all deposits were doing business.

March 15th: New York Stock Exchange reopened. Largest one day rise ever, 15%.

1 This was reported in the March 13th 1933 issue of Barrons. Scroll down to the summary at this link.

2 FDR Inaugural March 4th 1933

3 The time line is primarily drawn from Conrad Black “Franklin Delano Roosevelt: Champion of Freedom” NY 2003 pp 253-274. Herbert Feis “1933 Characters in Crisis” Boston 1966 provides supplementary information in Chapter 10 ‘The Defeated Depart’ p87, and Chapter 11 ‘The New Group’ p 95.

4 David M. Kennedy “Freedom From Fear. The American People in Depression and War 1929-1945” NY 1999. See Chapter 3, ‘The Ordeal of Herbert Hoover’ pp. 80-103. (Trickle-Down p. 80) and Black op.cit. Chapters 6 and 7.

5 First Fireside Chat, March 12th 1933, On the measures adopted to deal with the banking emergency.

For a sneak preview, the next installment is Part III: FDR’s Brain Trust

. In it, White illustrates what FDR’s Brain Trust was, where it came from, and what it did. The entire series is on the ePluribus Media Journal in the FDR and the Unfinished Agenda feature.

Key Research by: AvaHome

ePluribus Media editors and fact checkers for this article: JeninRI, Aaron Barlow, Cache, standingup, cho, stoy, Roxy,Greyhawk and Vivian.

If you like what ePMedia’s been doing with research, reviews and interviews, please consider donating to help with our efforts.