The reference is obviously to the melt-down of the financial markets. The numbers are simply incomprehensible and I think many of us have trouble in conceptualizing what they really mean. There are references to numbers much bigger than the TARP at $700 billion.

What numbers are we really talking about?

Well, last night I read Jerome a Paris’ top recommended diary entry over at Daily Kos. There was a link in it to a NYT-article that gave a good break-down of the government’s commitments and actual spending so far.

Are you ready?

Beyond the $700 billion bailout known as TARP, which has been used to prop up banks and car companies, the government has created an array of other programs to provide support to the struggling financial system. Through March 18, the government has made commitments of about $9.9 trillion and spent $2.2 trillion.

What does that mean? How much is $9.9 trillion?

If we assume 300 million residents in the US, it means a whopping $33,000 for each and every person in the country. That’s $132,000 for a family of four. That is what the Masters of the Universe at Wall Street have achieved. All of us are subsidizing the crooks with what is a decent annual income for many.

But we’re not entitled to insight and oversight as to how the funds are spent?

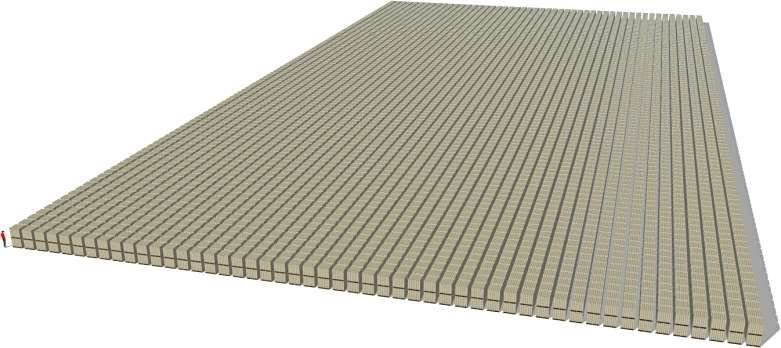

What does a trillion dollars look like? Well, imagine crisp, new 100-dollar bills stacked up neatly. A standard shipping pallet would contain a whopping $100 million (thus, the 8 billion in cash that went missing in Iraq would have been 80 pallets!).

But we’re far from a trillion. I followed a link in some diary yesterday which led to this page with great illustrations.

And this is what it looks like:

Notice those pallets are double stacked.

…and remember those are $100 bills.

You need $100 million ten thousand times to get to a trillion.

Go read Jerome’s entry and then look up Matt Taibbi’s article from the latest issue of Rolling Stone as recommended by so many yesterday. There is a good chance you’ll better understand what is going on after having read that.