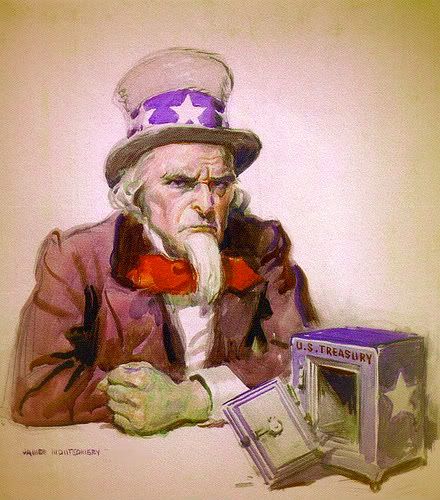

What’s wrong with Uncle Sam?

Was it something you said? Something you did?

Something you didn’t do?

If you’re over 50 years old, well yeah, some of what’s bothering Uncle Sam happened on your watch. But regardless of what age you are, you’re still in a lot of trouble.

The problem — which Uncle Sam is about to discover — is not that the vault is empty. The problem is that after it was emptied, America started borrowing. And borrowing.

Ludwig von Mises, a short-sighted 20th-century economist, was right about a few things. He said that when debt is recklessly expanded…

“There is no means of avoiding the final collapse of a boom brought about by credit [debt] expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit [debt] expansion, or later as a final and total catastrophe of the currency system involved.”

Mises, however, didn’t really know why crisis is unavoidable.

Ludwig von Mises didn’t have the imagination to see another way out. He was an Austrian. Moreover, he was born too early in the century, so he didn’t have enough experience with modern capitalism and global banking practices. He wasn’t really a big-picture guy, thus, he couldn’t see the flaw in the larger system.

That kind of out-of-the-box thinking is more typical of the French intellectuals. Let’s listen in on our resident French thinker, Lady Liberty. In the one-sided conversation, below, she tries to explain the problem to Uncle Sam:

|

:: “Yes, I re-checked the numbers.” :: “Wait, back up a minute. The Dollar is a unit of Debt — not Value. That’s why the vault is empty, okay? The “value” was spent a long time ago. Now, each Dollar is actually an IOU for money we borrowed by selling Treasuries — which are also IOUs, only bigger. When people use Dollars, they’re just trading IOUs for things they want.” :: “How much debt? Well, if you count all American debt, it comes to $55 trillion, give or take a trillion. That’s how much money we owe each other and the rest of the world.” :: “Of course I’m sure! You think I’m making this up? But that’s not the problem I’m…. What?” :: “No, the Gross Domestic Product has nothing to do with it. The GDP just measures how many Dollars people spend doing business with each other. It’s not money we can use to pay the IOUs. We can only use the taxes we get for that — and you know they keep cutting those.” :: “How much is the GDP? It was $14 trillion. That was before the bankers went global with their worthless derivatives.” :: “Let’s get back to the problem, okay? The problem is Interest. Interest that has to be paid on every Dollar we create. Interest was a really bad idea, Uncle Sam. Interest must always be paid on debt-based currency. Even if it’s in your pocket you still pay interest in the form of inflation. Interest forces us to grow and inflate constantly. If the GDP or inflation rate doesn’t increase at least 3 percent a year, the entire economy will collapse. All because of Interest.” :: “That’s what I mean about the math. If you need constant growth to survive, then you’re caught in a cycle where your size keeps doubling until you implode.” :: “Sure, there are plenty of places where interest, or compounding interest, is not allowed, or where interest is tightly regulated, or where simple interest is considered enough. The people have just as much opportunity, more in fact, because the banks are partners with the people, instead of parasites siphoning off most of the wealth.” :: “Yes, we did print a lot of money — but that’s not the underlying problem. In theory, we could partially back our printed currency with gold, if we had to.” :: “The gold? It’s in the other vault.” :: “I hear it’s located in New Jersey, maybe. And, no, I haven’t seen it lately.” :: “You can’t see it right now. That guy with the beard, Bernanke, says it’s not available for viewing.” :: “No, not even you! Are you going to let me finish here?” :: “Okay, the underlying problem is fractional reserve banking. Each Dollar deposit the bankers take in, they loan back out ten times. They earn ten times the normal rate of interest. Let’s say the average consumer debt pays 15 percent interest. That means the banks make 150 percent on every dollar they lend, each year, within the private sector of the over all debt. Not only that, but the interest compounds — which means we pay interest on the interest.” :: “Debt slavery, that’s exactly what it is, Uncle Sam. What’s more, the people who try to save and get ahead, receive only 2 percent interest. So, they actually lose money. This kind of slavery has been used for centuries to control people’s lives, while transferring all the gains from the work of ordinary citizens to a few Plutocrats at the top. And with their money, the Plutocrats take over control of the the government.” :: “Oh sure. The information is out there. It shows up on all the charts and graphs. People are probably listening in on this conversation. But the people really have no knowledge about how economies work, even their own. They don’t know that they are disadvantaged compared to other nations. Did you know that finance is not part of the curriculum in grade school and high school? Not even in college! That’s how Americans became debt slaves. They even vote to cut taxes for the Plutocrats, who already do not pay equitable taxes on the wealth the United States generates.” :: “No, it’s not right. The nation is starving for the taxes it once enjoyed. That’s why the infrastructure has broken down. And that’s why we we don’t have modern public transportation like other nations. We don’t even own our own natural resources like other nations do. They’re owned and exploited by private corporations.” :: “Yes, I know they are your resources — your minerals, your oil. But the Plutocrats took ownership of them — along with the wealth they create. And, that’s another reason there is so much debt. And that’s how the Dollar ended up being a debt-based currency. It’s not backed by anything of value — and it is highly leveraged as well.” :: “By leveraged, I mean that there is a minimum of $10 dollars of debt cramed into each $1 bill. The bankers gave themselves permission to resell the same loans over and over again (fractional reserved banking)– so new debt must be continuously created just to pay the compounding interest on the previous debt!” :: “No, it doesn’t matter whether it’s private debt or government debt. Both sectors must take on more and more debt just to service the interest on their existing debt. Otherwise, the currency would collapse and become worthless. This is basic debt-based currency mathematics.” :: “Are you still with me? We’re almost there.” :: “Good. We know that the current total debt in the US is around $55 trillion, right? That means that the debt service, even at a small nominal rate of only 5 percent, would be [5% X $55 trillion) $2.75 trillion per year.” :: “Exactly! This is more Dollars than exist on the planet — even after we recently doubled the money supply by printing an extra $1.5 trillion.” :: “So, there are not enough real Dollars in circulation to service the current outstanding debt in the US, much less all the off-balance-sheet CDO debt created by the shadow banking system. Since the private sector can’t borrow or spend much these days, the bankers are forcing the government to borrow. Like TARP. And they pay themselves the enormous leveraged profits that result from fractional lending.” :: “Yes, we have to lend them the money. If the exponentially growing debt isn’t promptly serviced, the Dollar will become worthless overnight and the US economy would collapse. Which Ludwig von Mises correctly pointed out is inevitable.” :: “How long? Well, the whole world already knows, but some of our creditors (the other central banks) are pretending they don’t until they can reduce their exposure to the Dollar or trade for real US assets.” :: “What should you do? Well…” :: “I didn’t tell you this, okay? But, if I were you, I’d hold Euros.” |

Even Paul Farrell over at the The Wall Street Journal’s MarketWatch commented along this line earlier in the week:

As for for Wall Street and American capitalism, use your gut. You know something’s very wrong:

A year ago, too-greedy-to-fail banks were insolvent, in a near-death experience. Now, magically, they’re back to business as usual, arrogant, pocketing outrageous bonuses while Main Street sacrifices, and unemployment and foreclosures continue rising as tight credit, inflation and skyrocketing federal debt are killing taxpayers.

Yes, Wall Street has lost its moral compass. It created the mess, but now, like vultures, Wall Streeters are capitalizing on the carcass. They have lost all sense of fiduciary duty, ethical responsibility and public obligation.

The coming collapse is the end of an “inevitable” historical cycle stalking all great empires to their graves. Downsize your lifestyle expectations, trust no one, not even media.

There is a high probability of a crisis and collapse by 2012. The “Great Depression 2” is dead ahead. Unfortunately, there’s absolutely nothing you can do to hide from this unfolding reality or prevent the rush of the historical imperative.

Farrell says there’s nothing you can do to hide from it?

He has an imagination not unlike Ludwig von Mises.

Opportunity abounds when you know in advance what’s going to happen.

__________

This has been cross-posted at Daily Kos.

![Educating Uncle Sam [about the Dollar]](https://progresspond.com/wp-content/uploads/2019/03/pattern-1-1280x640.jpg)

“Uncle Sam, I’ve done the math. It just doesn’t add up. What I mean is, the economy doesn’t work at all. We’re ruined, Uncle Sam.”

“Uncle Sam, I’ve done the math. It just doesn’t add up. What I mean is, the economy doesn’t work at all. We’re ruined, Uncle Sam.”