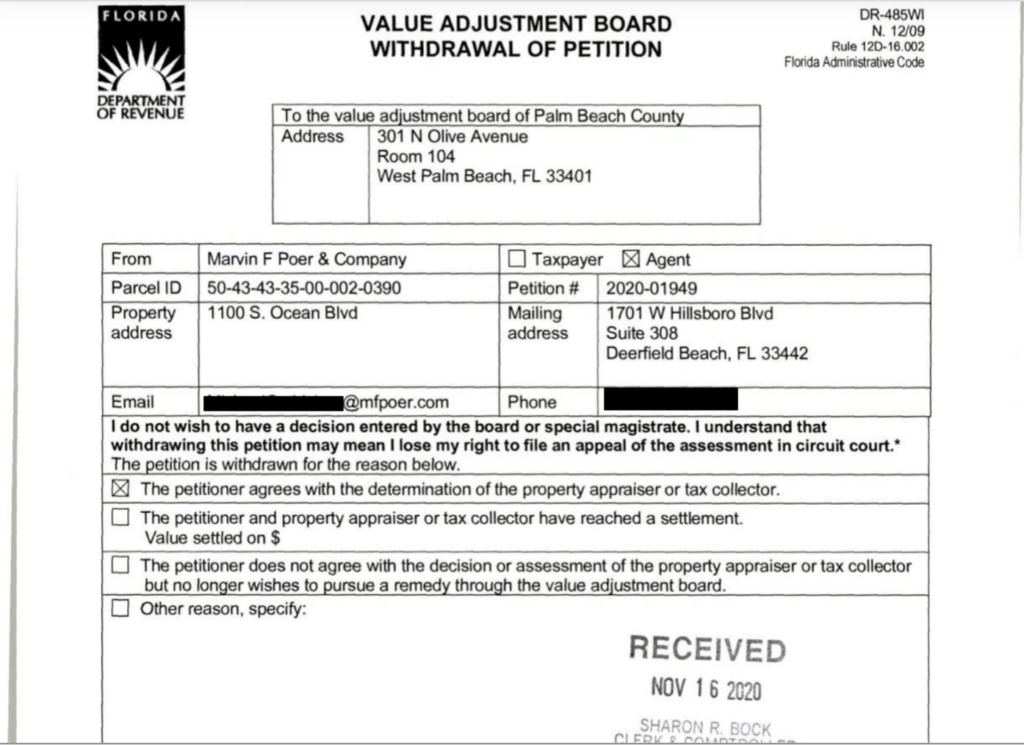

When you look at the image below, I want you take note of a few things. First, note the date, which is Nov. 16, 2020, a period in time in which Donald Trump had lost his bid for reelection and was beginning to plot a coup to stay in power. Second, note that it is a withdrawal of a previous petition to challenge the Palm Beach County assessment of the value of the Mar-a-Lago estate. Third, note the checked box which reveals the reason for the withdrawal: “the petitioner agrees with the determination of the property appraiser or tax collector.”

At that time, the agreed assessment was $26.6 million. The 2023 appraisal is $37 million.

According to the Palm Beach Daily News, the petition was an effort to lower Trump’s tax bill by arguing that the $26.6 million appraisal was too high, but Trump argues now (with some support) that it was actually too low. It’s unclear why the effort was dropped.

Of course, Trump is on trial in New York precisely for arguing is some contexts that his property has a high value and in other contexts that it has low value depending on which would benefit his bottom line. This includes his portrayal of the value of Mar-a-Lago, which we see here he agreed for tax purposes (after dropping a challenge that it was actually lower) was worth $26.6 million in 2020, but for securing a loan purposes argued at the time was worth between $427 million and $612 million. Now he’s arguing it’s actually worth $1.5 billion.

If you’re curious, one of the reasons there’s so much dispute about Mar-a-Lago’s true value is that it’s not supposed to be a private residence, and that substantially lowers its value. Trump argues that he can get that restriction lifted but the judge in New York noted that it’s fraud to treat it as if it has been lifted when it hasn’t.

That’s a legal point that might trip up your average MAGA supporter, but it’s key to why Trump is on trial and may lose much of his real estate empire. And every time he goes before a camera and says Mar-a-Lago is worth more than a billion dollars, he’s strengthening the case against him. Because the basic charge is that he inflates the value when it suits him and deflates it when it doesn’t suit him, and when you do that on official banking and tax documents, it’s against the law.

Now, just in case you’re slow, back in 2020 Trump owed $511,673 in property taxes on Mar-a-Lago. He thought that was too high so he challenged the $26.6 million dollar assessment. For unknown reasons, he dropped that challenge. But imagine how he would have felt about his tax bill if it was based on an assessment of $1.5 billion? In that case, by my estimates, his tax bill would have been almost $29 million instead of $511,673.

In other words, his tax bill would have been higher than the assessment he challenged.

That kind of staggering difference is the problem. We can argue about what Mar-a-Lago is worth, but whatever it is worth that number has to remain the same for both banking and tax purposes.

Meh, the only thing that matters is what he says on paper with a signature and under oath. Trump supporters not only don’t care, they think it’s awesome when the government is thwarted by their cult leader.