Richard Wolff of the Guardian on the so-called US economy’s recovery:

The so-called economic “recovery” since mid-2009 was chiefly hype, a veneer of good news to disguise and minimise the awful underlying economic realities. The few (large corporations and the rich) who bear much of the responsibility for the crisis made sure that the government they finance used massive amounts of public money to support a recovery for them. The mass of the population was excluded from the government-financed recovery for the few. We now have the summary official statistics to expose this grotesque injustice. […]

What did recover in the US, partly or wholly, were only corporate profits (especially those of banks) and the stock markets. […]

… From the depths of the crisis in early 2009 until now, there has been absolutely no recovery whatsoever in wages or jobs for US workers.

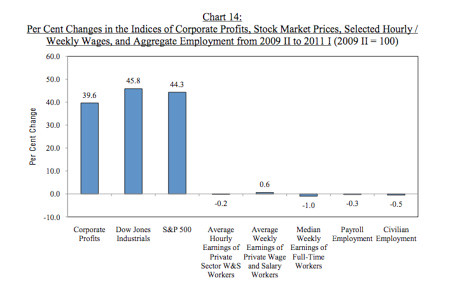

Hardly a shock to anyone who has been laid off or can’t find a job, or is working twice as hard for less money. Still, it’s worth reminding people that just as their is gross inequality in income and wealth in America between those at the top and everyone else, so also the “economic recovery” that the CEO’s of the major banks are so worried about “their recovery” collapsing if the debt ceiling is not raised, has been just as unequal. Here’s a chart from the May, 2011 report by the Center for Labor Market Studies (CLMS), Northeastern University, Boston, Massachusetts, “The “Jobless and Wageless” Recovery from the Great Recession of 2007-2009” that provides a nice display of that inequality:

As you can see, corporate profits rose 39.6%, The Dow Jones Industrials rose 45.8% and the S&P 500 Index rose 44.3% from the second quarter of 2009 to the the first quarter of 2011. In that same period private sector workers saw their average hourly earnings decline by -0.2%, their average weekly earnings rise a mere 0.6% (more overtime one can assume for those still employed), payroll employment fell by -.3% and Civilian Employment fell by -.5%. From page 23 of the CLMS report:

To date, through the first quarter of 2011, the nation’s recovery from the 2007-2009 recession is both a jobless and a wageless recovery. Aggregate employment still has not increased above the trough quarter of 2009, and real hourly and weekly wages have been flat to modestly negative. The only major beneficiaries of the recovery have been corporate profits and the stock market and its shareholders. Most holders of savings and money market accounts also are net losers due to declining real interest rates which have been in negative territory for many interest bearing and money market accounts.

So, the private sector still has not recovered the jobs that were lost in 2007 and 2008, though shareholders and senior executives are doing nicely, thank you very much. Of course, since the 2010 elections we have seen dramatic decreases on public sector employment as states laid off workers right and left (no pun intended).

As government stimulus winds down and states move to close massive budget gaps, public sector cuts should continue to grow, labor market experts say.

While the overall picture painted in the report is gloomy, the bigger story may lie in cuts on the government front. In June, local governments reported job losses of 18,000, and the federal government shed 14,000 jobs. Nearly 100,000 local government employees have lost their jobs so far this year, and 464,000 have found themselves jobless since local government employment peaked in September 2008.

The wealthy and major corporations have “recovered” their losses from the “2007-2009 recession” but everyone else has nothing to celebrate. Maybe we should call it the “Top 1% Recovery” because for almost all Americans their economic situation either has not improved or has gotten worse. Yet, what is the House debating about this afternoon? A bill to raise the debt ceiling (for 6 months only) that would require no tax increases for the people who benefited from this “recovery” only spending cuts that would increase public sector unemployment. It would also require a panel to find further spending cuts of 1.6 Trillion dollars or more (cuts the Speaker Orange Man declares should come from Social Security, Medicare and Medicaid) that must be approved by Congress and signed into law by the President before the debt ceiling can be raised again!

President Obama has talked about shared sacrifice. The Republicans seem to think that means everyone except the rich should be sacrificed on the altar of corporate profits and increased wealth for the our nation’s richest citizens. It’s interesting to note that the letter sent to President Obama by the Wall Street Banksters primarily focused on the consequences to the bond and stock markets if the debt ceiling is not raised.

“A default on our nation’s obligations, or a downgrade of America’s credit rating, would be a tremendous blow to business and investor confidence – raising interest rates for everyone who borrows, undermining the value of the Dollar, and roiling stock and bond markets – and, therefore, dramatically worsening our Nation’s already difficult economic circumstances,” they wrote.

Well, it would certainly dramatically effect their economic circumstances. But simply raising the debt ceiling isn’t going to do much for the rest of us, and a debt ceiling bill that requires immediate cuts to federal spending will undoubtedly without any increases in revenues will make the situation of millions of Americans worse, regardless of whether it bolsters “investor confidence” in the markets.

Someone tell Obama it’s 3am and the phone is ringing. it’s time for Obama to step up and lead instead of making comments from the sidelines.

not hopeful or changeful, steven. not hopeful and changeful AT ALL.

that said, buy a membership to BJs wholesale. buy larhe quantities of rice and water. In my area, they don’t do the bulk packs of beans, but they are cheap in the grocery. buy them.

and also, buy a hand-operated water filter. PUR makes a good one. berkey is supposed to be good too, but expensive. make sure you get extra filters, regardless.

make friends with your neighbors: a weekly or twice a week potluck feeds a lot of people, at a low price.

Advice from a member of the no-longer-working poor, should-be middle class.

Simple answer for simple question:

the dollar value of production.

Production rises in a pretty continous fashion. Employment rises (for full time jobs) in $20K quanta. Investment in capital equipment can increase productivity per worker.

Long work days can increase production per worker.

So the real quantum for a new job is closer to the average wage of $40K.

What drives production is demand plus replenishment of inventory. Most places have developed lean supply chains. Replenishing inventories in previous recessions forced increased production which then stimulated demand that justified that level of production. Lean supply chains mean that unintended stabilizer is gone.

It will take steady growth in the dollar value of production of 3%-4% per year to keep up with the growth in the workforce from population increase. Typical recession recovery growth rates bust 10%.

Of course profits have grown, but it has not been from production as much as an asset bubble reinflated with TARP and Fed assistance. The financial sector is making accounting profits by trading with each other. Everything else is struggling. Flat is considered successful; you are still in business. Restaurants that cater to workers have been hit hard. As have other service businesses.