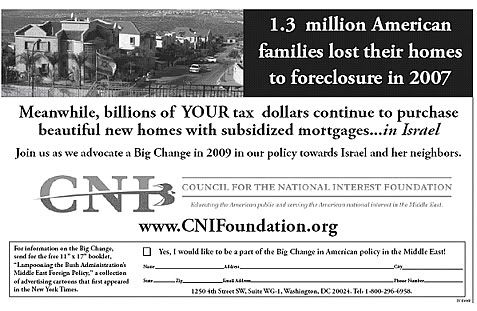

Denver Post ad to Democratic delegates placed by the Council for the National Interest.

1.3 million Americans have lost their homes to foreclosure in 2007. Yet, billions of our tax dollars continue to pour into Israel in order to subsidize cheap mortgages for homes for Israeli settlers in the West Bank, Palestine, inside illegal settlements that continue to grow and impede a fair and just solution to the Israeli-Palestinian conflict. A cheap mortgage is one way the government of Israel has induced immigrants to move into the West Bank and East Jerusalem.

Israeli spending on settlements is estimated to be over $550 million a year, which makes clear that the government has no intention of permitting the establishment of a Palestinian state. Roughly 10,000 Israeli settlers establish residence in the Palestinian territories every year.

This article from Reuter will also shock Americans who have recently lost their homes to foreclosure, while their government willingly gives tax breaks to allegedly “charitable” organizations that do nothing more than help fund cheap mortgages for settler homes on stolen Palestinian lands.

EXCLUSIVE-US tax breaks help Jewish settlers in West Bank

26 Aug 2008

By Adam Entous

ReutersThe United States says Jewish settlements in the occupied West Bank threaten any peace between Israel and the Palestinians — yet it also encourages Americans to help support settlers by offering tax breaks on donations.

As Condoleezza Rice flew in on Monday for another round of peace talks, Israeli and American supporters of settlements defended the tax incentives, which benefit West Bank enclaves deemed illegal by the World Court and which the U.S. secretary of state has said are an obstacle to Palestinian statehood.

Pro-settler groups say they are entitled to the tax breaks because their work is “humanitarian”, not political, and reject any comparison to Palestinian charities, some of which face U.S. sanctions over suspected links to Islamist groups like Hamas.

The full extent of tax-exempt U.S. funding for settlements is unclear because so many groups are involved and their spending practices are not always transparent. But a review by Reuters of U.S. tax records found 13 tax-exempt organisations openly linked to settlements that have raised more than $35 million in the last five years alone.

LINK above for the full article.

Noam Shelef of Americans for Peace Now, which supports an Israeli group opposed to settlement in the West Bank, where some 2.5 million Palestinians live, called the US policy inconsistent. Palestinian negotiator Saeb Erekat said the tax breaks “contradict American policy”, adding: “Either they stop the settlements or they stop talking about a two-state solution.”

In other related news:

Land Grabs and Lawsuits appeared in the Montreal Mirror on August 22, 2008:

Two Quebec-based firms are being sued in Canada by the occupied West Bank Palestinian village of Bi’lin. Accused of war crimes for their involvement with Israeli settlement expansion, two Quebec-registered companies are being sued in Canada by the occupied West Bank Palestinian village of Bi’lin.

Toronto lawyer Mark Arnold filed a claim in Quebec Superior Court on behalf of the village against Green Park and Green Mount International three weeks ago. The case is part of a combined Palestinian, Canadian and Israeli effort to halt expansion of the Modi’in Illit settlement.

The sister construction companies are being charged with violating both Canadian and international law, while also acting as agents of the Israeli state due to their construction of residences in Mattityahu East, a hilltop adjacent Modi’in Illit’s main settlement block. Calling the case unprecedented, Arnold cites the Fourth Geneva Convention and Canada’s Crimes Against Humanity and War Crimes Act.

LINK above for the rest of the article.

UPDATE: The following statistics from the Washington Report on Middle East Affairs was drawn to my attention:

http://www.wrmea.com/html/us_aid_to_israel.htm

THE STRATEGIC FUNCTIONS OF U.S. AID TO ISRAEL

By Stephen Zunes

Dr. Zunes is an assistant professor in the Department of Politics at the University of San FranciscoSince 1992, the U.S. has offered Israel an additional $2 billion annually in loan guarantees. Congressional researchers have disclosed that between 1974 and 1989, $16.4 billion in U.S. military loans were converted to grants and that this was the understanding from the beginning. Indeed, all past U.S. loans to Israel have eventually been forgiven by Congress, which has undoubtedly helped Israel’s often-touted claim that they have never defaulted on a U.S. government loan. U.S. policy since 1984 has been that economic assistance to Israel must equal or exceed Israel’s annual debt repayment to the United States. Unlike other countries, which receive aid in quarterly installments, aid to Israel since 1982 has been given in a lump sum at the beginning of the fiscal year, leaving the U.S. government to borrow from future revenues. Israel even lends some of this money back through U.S. treasury bills and collects the additional interest.

In addition, there is the more than $1.5 billion in private U.S. funds that go to Israel annually in the form of $1 billion in private tax-deductible donations and $500 million in Israeli bonds. The ability of Americans to make what amounts to tax-deductible contributions to a foreign government, made possible through a number of Jewish charities, does not exist with any other country. Nor do these figures include short- and long-term commercial loans from U.S. banks, which have been as high as $1 billion annually in recent years.

Total U.S. aid to Israel is approximately one-third of the American foreign-aid budget, even though Israel comprises just .001 percent of the world’s population and already has one of the world’s higher per capita incomes. Indeed, Israel’s GNP is higher than the combined GNP of Egypt, Lebanon, Syria, Jordan, the West Bank and Gaza. With a per capita income of about $14,000, Israel ranks as the sixteenth wealthiest country in the world; Israelis enjoy a higher per capita income than oil-rich Saudi Arabia and are only slightly less well-off than most Western European countries.

AID does not term economic aid to Israel as development assistance, but instead uses the term “economic support funding.” Given Israel’s relative prosperity, U.S. aid to Israel is becoming increasingly controversial. In 1994, Yossi Beilen, deputy foreign minister of Israel and a Knesset member, told the Women’s International Zionist organization, “If our economic situation is better than in many of your countries, how can we go on asking for your charity?”

U.S. Aid to Israel: What U.S. Taxpayer Should Know

by Tom Malthaner

This morning as I was walking down Shuhada Street in Hebron, I saw graffiti marking the newly painted storefronts and awnings. Although three months past schedule and 100 percent over budget, the renovation of Shuhada Street was finally completed this week. The project manager said the reason for the delay and cost overruns was the sabotage of the project by the Israeli settlers of the Beit Hadassah settlement complex in Hebron. They broke the street lights, stoned project workers, shot out the windows of bulldozers and other heavy equipment with pellet guns, broke paving stones before they were laid and now have defaced again the homes and shops of Palestinians with graffiti. The settlers did not want Shuhada St. opened to Palestinian traffic as was agreed to under Oslo 2. This renovation project is paid for by USAID funds and it makes me angry that my tax dollars have paid for improvements that have been destroyed by the settlers.

Most Americans are not aware how much of their tax revenue our government sends to Israel. For the fiscal year ending in September 30, 1997, the U.S. has given Israel $6.72 billion: $6.194 billion falls under Israel’s foreign aid allotment and $526 million comes from agencies such as the Department of Commerce, the U.S. Information Agency and the Pentagon. The $6.72 billion figure does not include loan guarantees and annual compound interest totalling $3.122 billion the U.S. pays on money borrowed to give to Israel. It does not include the cost to U.S. taxpayers of IRS tax exemptions that donors can claim when they donate money to Israeli charities. (Donors claim approximately $1 billion in Federal tax deductions annually. This ultimately costs other U.S. tax payers $280 million to $390 million.)

When grant, loans, interest and tax deductions are added together for the fiscal year ending in September 30, 1997, our special relationship with Israel cost U.S. taxpayers over $10 billion.

Since 1949 the U.S. has given Israel a total of $83.205 billion. The interest costs borne by U.S. tax payers on behalf of Israel are $49.937 billion, thus making the total amount of aid given to Israel since 1949 $133.132 billion. This may mean that U.S. government has given more federal aid to the average Israeli citizen in a given year than it has given to the average American citizen.

I am angry when I see Israeli settlers from Hebron destroy improvements made to Shuhada Street with my tax money. Also, it angers me that my government is giving over $10 billion to a country that is more prosperous than most of the other countries in the world and uses much of its money for strengthening its military and the oppression of the Palestinian people.