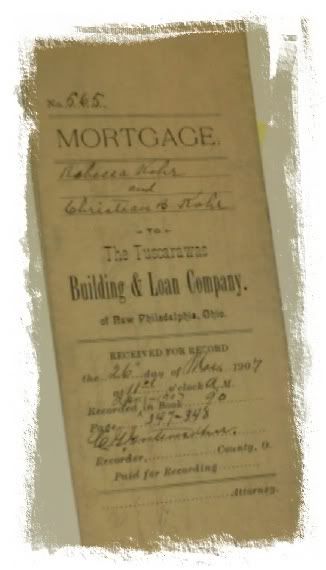

In the Olden Days (B.D. — Before Deregulation)

- you want to buy a House

- you put 10-20% down and got a mortgage loan, after intensive scrutiny of your income and creditworthiness

- you spend 30-years making monthly Mortgage Payments

- you take Ownership of your Home, free and clear.

5) IF you fail to make Mortgage Payments, for 3 months or more, a Snidely Whiplash character would show up from the Bank, and promptly put you out on the street.

Fortunately (or unfortunately?) in these 21st century days of Investment Banks and Hedge Funds, riding herd in a “wild west” electronic economy with little to NO Oversight, you may still default on your Mortgage — yet too often it seems, that No One really knows, exactly WHO owns your House, when you do …

Banks used to have a stake in your Home. It was their “bread and butter”. Steady, safe, Interest Income, plus the “capital assets” of all those homes on their ledger — it’s what made Bankers “stodgy” and boring.

But with the passage of The Gramm-Leach-Bliley Act in 1999, which allowed commercial and investment banks to merge and consolidate, the newly empowered Investment-Bankers decided that the Business of Mortgages could bring in many other possible “income streams”, given some Enron-like creative financing.

Afterall, what could be a more valuable “commodity”, than those Millions of US Homes, who’s annual value, only goes up, Up, UP, year after year?

If only they could turn that “appreciating commodity” into a convenient tradeable security — then they could really make some Money!

Guess what, they did just that!

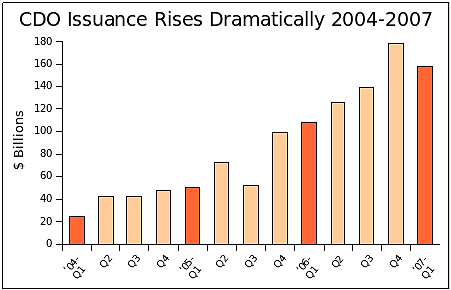

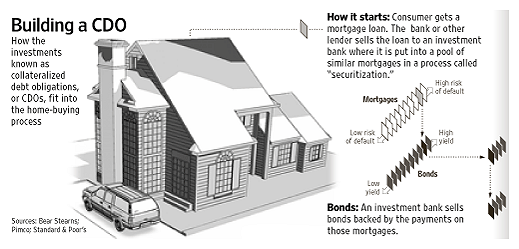

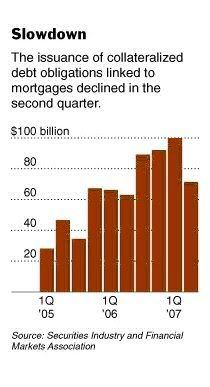

They’re called Collateralized Debt Obligations, or CDO; CDO’s are bond-like investment vehicles, which like Mutual Funds, they “minimize risk” by bundling together 1000’s Mortgages into tradeable contracts. What’s a CDO? Click Here for Easy-to-Follow Graphic

Like most ideas based on “casting a wide net”, these CDO Bundles often picked up both the “good and the bad” Mortgages, in their sweeps.

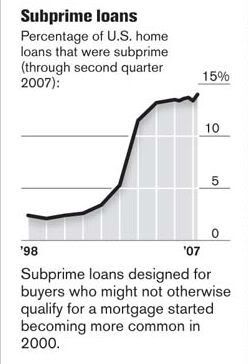

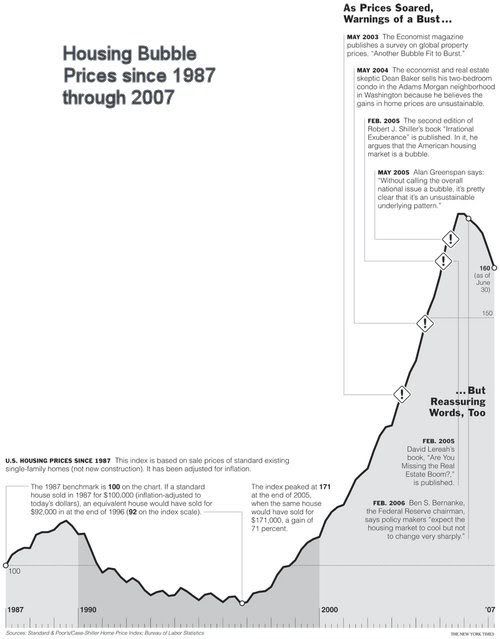

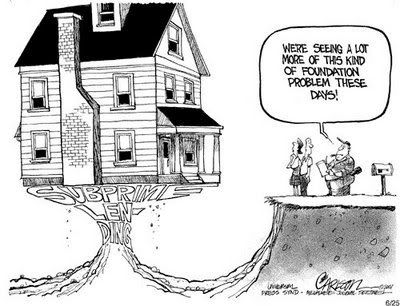

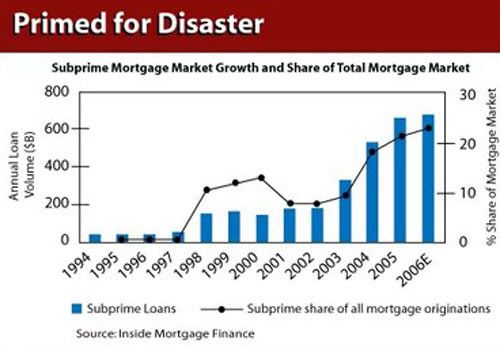

Once again thanks to Deregulation, this past decade has witnessed the growth of a “cottage industry” called “Sub-Prime” Mortgages. These “no standards” Mortgages, made “no standards” Bankers even richer, all the while fueling the phenomenal growth in the “Average Price of a Home” in the US. (aka. the Housing Bubble)

Luckily for these “Sub-Prime” Sheisters, they could sell those questionable Sub-Prime Mortgages, and take the profit, while not having to “take ownership of the risks” associated with them. (Snidely Whiplash-types don’t really want your House, they want your Money — it’s call OPM — “Other People’s Money” — and leveraging that is the key to their wealth.)

They could simply bundle up all those “pump and dump” Mortgages, into a handy CDO, and pawn them off, on the burgeoning Investment Banks and Hedge Fund firms, that were popping up like weeds, and rushing to Wall Street, “to get theirs — while the getting’s good.” (Thanks again “Free Market Deregulation”, good job! Way to create opportunity for all!)

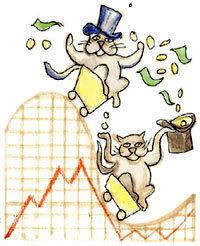

The scheme worked, as long as the value of Homes went up …

But as soon as the Housing Bubble Burst, those Investment Bankers and Hedge Funds, with all those CDO’s on their books, just couldn’t get rid of those “hot potato” investments faster enough! — Problem is, no one wanted to buy those toxic CDO’s! (just like no one is buying actual Homes much, these days either! everyone waiting for the falling prices to stabilize.)

And when the Value of those underlying assets inside the CDO’s, (the homes) are on shaky ground,

Then those “risky” CDO’s start to de-value and default too. This has fueled a rush on “Investment Insurance” market, in hopes of protecting the CDO’s themselves.

Enter “Credit Default Swaps”, or CDS.

Necessity, is the mother of invention, once again on Wall Street … Above all else their Profits must be protected.

Call it “greasing the Wheels of the Economy”, or some such nonsense, above all else, save the “fat cats” from having to pick up all those collapsing Mortgages:

SO that’s what those clever financiers did!

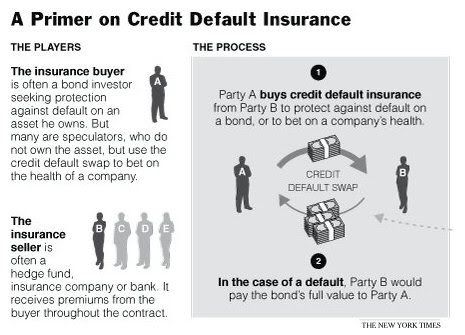

The concept behind “Investment Insurance” otherwise known as “Credit Default Swaps”, (CDS), is that the Banker is “vouching for” value of the CDO’s. (aka “covering” the investment)

These Banker-backed contracts put the Hedge Funds (and other Bankers) holding those CDO’s at ease, but they really didn’t address the root problem: ie. Bad Mortgages that NO ONE seems to owns anymore

New York Times

Arcane Market Is Next to Face Big Credit Test

By GRETCHEN MORGENSON – Feb 17, 2008

Credit default swaps form a large but obscure market that will be put to its first big test as a looming economic downturn strains companies’ finances. Like a homeowner’s policy that insures against a flood or fire, these instruments are intended to cover losses to banks and bondholders when companies fail to pay their debts.

The market for these securities is enormous. Since 2000, it has ballooned from $900 billion to more than $45.5 trillion — roughly twice the size of the entire United States stock market

No one knows how troubled the credit swaps market is, because, like the now-distressed market for subprime mortgage securities, it is unregulated. But because swaps have proliferated so rapidly, experts say that a hiccup in this market could set off a chain reaction of losses at financial institutions, making it even harder for borrowers to get loans that grease economic activity.

…

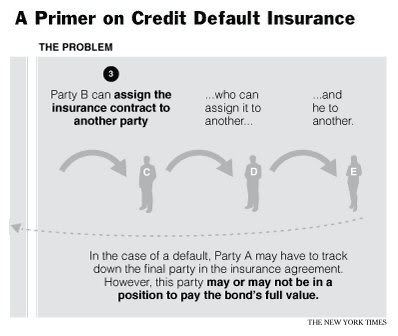

As investors who have purchased such swaps try to cash them in, they may have trouble tracking down who is supposed to pay their claims.

…

It would be as if homeowners, facing losses after a hurricane, could not identify the insurance companies to pay on their claims. Or, if they could, they discovered that their insurer had transferred the policy to another company that could not cover the claim.

(emphasis added)

http://www.nytimes.com/2008/02/17/business/17swap.html?ref=todayspaper

CDS are like a transferable insurance policy, that ultimately may end up backed by the “credit and trust” of no one???

(well actually by the Lender of last resort — the US Tax payer)

Who invented these things, anyways?

Sadly, that’s not the WORST Problem with Investment Bank-issued CDS’s — it’s the Total Size of this Insurance Market that is really the “soulless villain” in this Saga of Unbridled Greed:

This is “the WHY” behind Why these Investment Banks CAN NOT Fail!

No Doubt, Treasury Secretary Henry Paulson is very well aware of that hidden $45 Trillion CDS Market — immediately payable as each … new … Investment Bank … fails.

Thus the Urgent Crisis we’ve all be thrust into.

This “phantom” Insurance market is worth TWICE as much as the entire US Stock Market, and 6 TIMES as much as the Mortgage Security Market, they’re supposedly insuring!!!

How did this happen? Who’s been “minding the store” on Wall Street?

Bloomberg

Hedge Funds Double Share of Fixed-Income Trade

By Jenny Strasburg — Aug. 30 2008

“The recent expansion of hedge-fund positions and trading activity has been so rapid and consistent that it is now no exaggeration to say that hedge funds are no longer just an important part of the market in some fixed-income products; they are the market,“

…

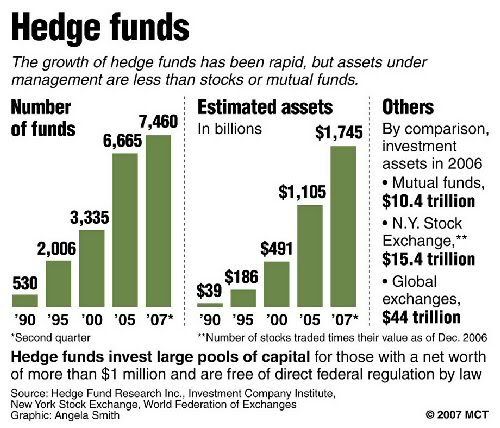

Hedge funds accounted for more than 80 percent of trading in the debt of financially distressed companies and high-yield derivatives such as credit-default swaps, the Greenwich, Connecticut-based consulting and research firm said. The loosely regulated investment pools generated almost half of U.S. trading volume in structured credit.Hedge-fund assets worldwide increased almost threefold in the past five years to $1.75 trillion as of June, according to Chicago-based Hedge Fund Research Inc.

…‘Take Careful Note’

Hedge funds’ share of structured-credit trades shows that the funds “have become the biggest force” in markets for many debt instruments that are often are the most complex to price and trade, Frank Feenstra, a Greenwich Associates managing director, said in the report. “With all of the current issues surrounding subprime-mortgage debt and collateralized-debt obligations, investors should take careful note of this finding.”

(emphasis added)

http://www.bloomberg.com/apps/news?pid=20601087&sid=ac8qb.Wc1X5I&refer=home

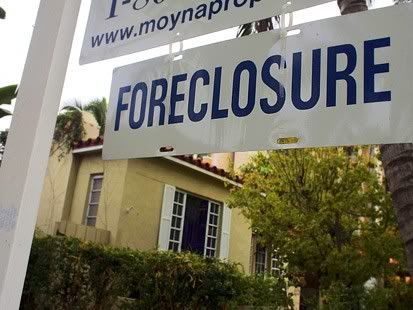

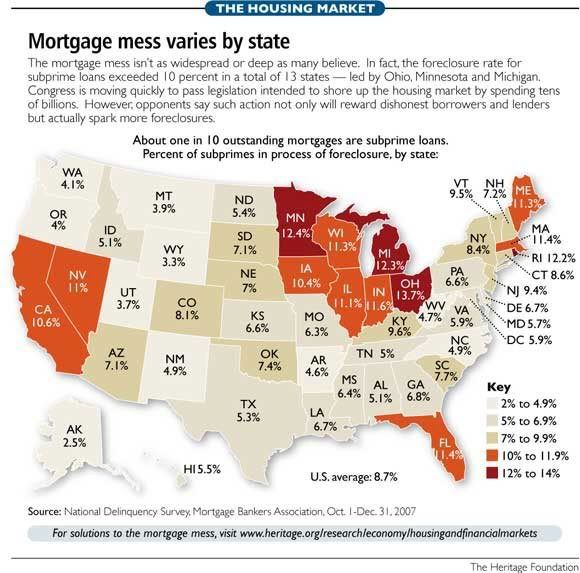

Speaking of Sub Prime Mortgage debt, it’s showing very little sign of recovery. That Greed-driven bubble has burst, and Mortgage defaults are happening left and right:

(this is the Misery part of the story, afflicting the little guys, who’s money was exploited and leveraged by the Forces of Greed.)

There IS a very real risk of Total Market Meltdown, as so many Investment Banks continue to collapse, and that 45 Trillion dollars of CDS insurance, slowly becomes due:

Who’s holding all those “claims” on the “net worth” of US Housing Market assets? Who has bought up all those CDS’s?

One might guess China, Japan, and Saudi Arabia? Well, that could be, especially if they’ve found the right “front group” (ie. unregulated and opaque Hedge Fund) to manage all their Billions, and put them to work in the US (while the “getting’s still good”)

New York Times

Arcane Market Is Next to Face Big Credit Test

By GRETCHEN MORGENSON – Feb 17, 2008

[pg 2]

Years of a healthy economy and few corporate defaults led many banks to write more credit insurance, finding it a low-risk way to earn income because failures were few. Speculators have also flooded into the credit insurance market recently because these securities make it easier to bet on the health of a company than using corporate bonds.

Both factors have resulted in a market of credit swaps that now far exceeds the face value of corporate bonds underlying it. Commercial banks are among the biggest participants — at the end of the third quarter of 2007, the top 25 banks held credit default swaps, both as insurers and insured, worth $14 trillion, the currency office said, up $2 trillion from the previous quarter.

JPMorgan Chase, with $7.8 trillion, is the largest player; Citibank and Bank of America are behind it with $3 trillion and $1.6 trillion respectively.

But many speculators, particularly hedge funds, have flocked to these instruments to bet on a company failure easily. Before the insurance was developed, such a bet would require selling short a corporation’s bond and going into the market to borrow it to supply to the buyer.

The market’s popularity raises the possibility that undercapitalized participants could have trouble paying their obligations.

(emphasis added)

http://www.nytimes.com/2008/02/17/business/17swap.html?_r=1&adxnnl=1&oref=slogin&ref=tod

ayspaper&pagewanted=2&adxnnlx=1222549726-wfmnY2mDRFX/R5WkOU57JQ

So much for Reaganomics, and letting the “Free Markets” work its magic!

Where is that “Invisible Hand” of Supply and Demand, that’s supposed to rise up and automatically fill all market voids?

(Why aren’t the CDO’s clearing the market anymore? What’s the fair price, in a market that has no floor?)

It seems that the only thing that has been partially filled, has been the the insatiable Greed of the Super Rich, to get even Richer! No matter the damage to the fabric of society they leave in their wake — long as they get theirs!

(That’s why God created OPM by the way, don’t ya know? as Sara Palin might say.)

In my opinion, “laissez faire” Free Markets left unchecked will NEVER provide for the “common good” of Society, nor will they be “self-regulating” for the greater good, in any serious way —

(Where’s the Profit in that? — the Titans of Capital will always ask. There will always be some new Sheisters who rise up to “cut all the wrong corners” — that void, always gets fill in a Deregulated market!)

It’s time for Market Regulation again in America.

It’s time for Transparency in these Investing power houses, otherwise known as Hedge Funds.

It’s time to send dozens of new Sheriffs to Wall Street, before the Forces of Greed, really do something dastardly!

Put unchecked Bankers, Greed, and Billions of Dollars of Speculator’s money to work in 21st Century lighting-fast deregulated markets — and WHO knows, you just might end up doing some REAL DAMAGE?

Like selling “Park Place” and “Boardwalk”, just to get a hold of that “Get Out of Jail Free” Card …

Stranger things have happened … in the name of the all-mighty Dollar …