We’ll get to Eric Cantor in a minute but first a little good news …

Every year someone gets caught using inside information to cheat and place sure bets on stock trades. This is (if you did not know it before) a federal and (usually) a state crime (for most people). Now, the fact that insider trading is the equivalent of fraud, which is punishable as a felony under federal law, discourages many people who are inclined to disregard the law and risk jail time for millions of dollars in profits, but every once in a while a US Attorney prosecutes people for violating the law against using inside information to game the system. Not as many people as all those who engage in it, of course, but every once in a while the Department of Justice actually makes a case and puts someone in jail, like this guy:

(Reuters) – A New York stock trader pleaded guilty to participating in an insider trading scheme that relied on inside information from a corporate lawyer at four prominent law firms and spanned over 15 years, the U.S. Attorney for the District of New Jersey announced in a press release on Thursday.

Amazing isn’t it? Presumably highly compensated attorneys at reputable and I suspect very profitable law firms, lawyers who worked on securities deals or who had privileged information about their clients that might influence said clients’ stock prices, worked with this stock trader for FIFTEEN YEARS to make millions in illegal gains using that privileged information. Amazing to me anyway that they got caught, but I suppose like many organized crime figures, they got sloppy after a while and slipped up. Here are some excerpts from the press release issue by the District of New Jersey’s US Attorney’s office:

Garrett D. Bauer, 44, of New York, pleaded guilty to all four counts charged in the Information against him: conspiracy to commit securities fraud, securities fraud, conspiracy to commit money laundering and obstruction of justice. Bauer entered his guilty plea before U.S. District Judge Katharine S. Hayden in Newark federal court. […]

“Today, Garrett Bauer admitted that he used confidential information, stolen from major law firms, to make tens of millions in one of the largest, longest-running insider trading schemes ever prosecuted,” said U.S. Attorney Fishman. “After taking the lion’s share of the $37 million in profits, Bauer now faces punishment for conduct that undermines the fairness of our financial markets and the public’s trust in the safety of its investments. We have no tolerance for corporate insiders and their cronies who benefit themselves by using their positions and access to cheat the investing public.” […]

Bauer and two coconspirators – Matthew Kluger, 50, of Oakton, Va., and Kenneth Robinson, 45, of Long Beach, N.Y. – engaged in an insider trading scheme that began in 1994 and relied on Kluger, a lawyer, to steal information from his employers and their clients. […]

Over time, Kluger worked at four of the nation’s premier mergers and acquisitions law firms. From 1994 to 1997, he worked first as a summer associate and later as a corporate associate at Cravath Swaine & Moore in New York. From 1998 to 2001, he worked at Skadden, Arps, Slate, Meagher & Flom in New York and Palo Alto, Calif., as an associate in their corporate department. From 2001 to 2002, Kluger worked as a corporate associate at Fried, Frank, Harris, Shriver & Jacobson LLP in New York. From Dec. 5, 2005, to March 11, 2011, Kluger worked at Wilson Sonsini Goodrich & Rosati (“Wilson Sonsini”) as a senior associate in the Mergers & Acquisitions department of the firm’s Washington office.

While at the firms, Kluger regularly stole and disclosed to Robinson material, nonpublic information regarding anticipated corporate mergers and acquisitions on which his firms were working. Early in the scheme, Kluger disclosed information relating to deals on which he personally worked. As the scheme developed, and in an effort to avoid law enforcement detection, Kluger took information which he found primarily by viewing documents on his firms’ computer systems.

Once Kluger provided the inside information to Robinson, Robinson passed it to Bauer. Bauer then purchased shares for himself, Kluger, and Robinson in Bauer’s trading accounts, then sold them once the relevant deal was publicly announced and the stock price rose. Bauer gave Robinson and Kluger their shares of the illicit profits in cash – often tens or hundreds of thousands of dollars – that Bauer withdrew in multiple transactions from ATM machines. […]

This case was brought in coordination with President Barack Obama’s Financial Fraud Enforcement Task Force. President Obama established the interagency Financial Fraud Enforcement Task Force to wage an aggressive, coordinated, and proactive effort to investigate and prosecute financial crimes.

For those who don’t know much about the legal biz, Cravath Swaine & Moore and Skadden, Arps, Slate, Meagher & Flom are two of the biggest corporate law firms in New York and indeed in the country. They represent the crème de la crème of multi-national corporate clients and wealthy individuals, i.e., the .001%. According to its wikipedia entry, Skadden has nearly 2000 lawyers around the world and its revenues exceed $2 Billion per year. Its the tenth largest law firm in the world. It has represented many of the top fifty companies on the Fortune 500 list, principally in the practice areas of mergers and acquisitions, securities law, tax law and bankruptcy law.

Cravath is no slouch either. Its been around since 1854, and though it only has around 500 lawyers, its clients represent a virtual Who’s Who among large corporations and wealthy individuals. Needless to say it does a lot of work on the area of mergers and acquisitions (i.e., M&A), securities law, antitrust litigation (Microsoft is a client), etc.

Fried, Frank, Harris, Shriver & Jacobson (468 attorneys according to wikipedia, with offices in Europe and Hong Kong as well as NYC) and Wilson Sonsini Goodrich & Rosati are major firms as well, and both do a large number of large financial transactions from M&A work and IPO’s (initial public offerings) to private equity deals, complex financing transactions, securities law, antitrust law, etc. Wilson Sonsini Goodrich & Rosati also profits from many of its deals by taking securities in exchange for deferral of fees on IPO deals, one of which was Google.

So these are big players on Wall Street, and privy to valuable information regarding the Grand Casino on Wall Street to which poor schmucks like you and I will never have access. Not really a surprise that at least one of their employees (and I suspect frankly far more than one) have used access to that information to enrich himself and his fellow criminals. Especially so at a time when the budgets for the SEC and the Department of Justice Securities Fraud division have been under attack.

Of course, as Mr. Cantor’s efforts have made clear over the past few days, certain people are exempt for charges of illegal insider trading. Those people are known as our elected Congressional representatives. What would send you and me to jail, and will likely send Messrs. Bauer, Kluger and Robinson to federal prison, is of not much consequence to our Congressional representatives. Indeed, we know that they have been using this exemption to make money off of the inside information they acquire for years. For one example let me offer you the not so curious case of Rep. Spencer Bachus (R-AL):

According to a new book called Throw Them All Out by Peter Schweizer, as relayed by Dave Weigel at Slate, Rep. Bachus made more than 40 trades in his personal account in the summer and fall of 2008, in the early months of the financial crisis.

The fact that Bachus personally traded on private information he received as a result of his job is bad enough. The fact that he was the ranking member of the House Financial Services Committee at the time is simply outrageous.

In one case, the day after getting a private briefing on the collapsing economy and financial system from Ben Bernanke and Hank Paulson, Rep. Bachus effectively shorted the market (by buying options that would rise if the market tanked.)

A few days later, after the market tanked, Bachus sold his position and nearly doubled his money.

Read more: http://www.businessinsider.com/the-congress-insider-trading-scandal-is-a-disgrace-rep-spencer-bachus-should-resign-immediately-2011-11#ixzz1g2uE442O

Some more details about Bachus “grab the money and run” bonanza from Weigel’s book:

On the evening of September 18, at 7 p.m., Bachus received [a] private briefing for congressional leaders by Hank Paulson and Federal Reserve Bank Chairman Ben Bernanke about the current state of the economy. They sat around a long table in the office of Nancy Pelosi, then the Speaker of the House. These briefings were secretive. Often, cell phones and Blackberrys had to be surrendered outside the room to avoid leaks. […]

Bernanke [stated], “It is a matter of days before there is a meltdown in the global financial system.” Bachus was among those who spoke. According to Paulson, he suggested recapitalizing the banks by buying shares.

The meeting broke up. The next day, September 19, Congressman Bachus bought contract options on Proshares Ultra-Short QQQ, an index fund that seeks results that are 200% of the inverse of the Nasdaq 100 index. In other words, he was shorting the market. It was an inexpensive way to bet that the market would fall. He bought options for $7,846 on a day when the Dow Jones Industrial Average opened at 8,604. A few days later, on September 23, after the market had indeed fallen, he sold the options for over $13,000 and nearly doubled his money.

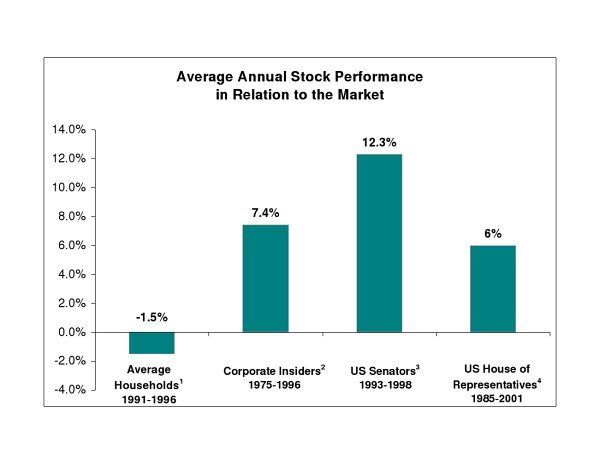

Of course, this is only one example of our corrupt representatives benefiting from the loophole in the Securities Fraud laws they created for themselves. Here’s a chart that shows how the securities portfolios of House and Senate members prospered far in excess of what than the average citizen in the 90’s who held securities earned:

Sources:

Alan J. Ziobrowski, PhD, Ping Cheng, PhD, James W. Boyd, PhD, and Briggitte J. Ziobrowski, PhD, “Abnormal Returns from the Common Stock Investments of the U.S. Senate,” Journal of Financial and Quantitative Analysis, Dec. 2004

Alan J. Ziobrowski, PhD, James W. Boyd, PhD, Ping Cheng, PhD, and Briggitte J. Ziobrowski, PhD, “Abnormal Returns From the Common Stock Investments of Members of the US House of Representatives” (321 KB), Business and Politics, May 2011.

As you can see, Mr. and Ms. Ordinary Investor’s portfolio underperformed the average return on stocks by a -1.5%. Senators on the other hand outperformed the market average by a whopping +12.3% with House members also outperforming the market by the lesser extent of +6%. Not a bad deal for those lucky duckies in Congress who could trade on inside information without fear that their actions would subject them to criminal prosecution.

Yet, now that this has all come to light thanks to a bill Louise Slaughter (S-NY) originally proposed in 2006, and a November 60 minutes expose on this loophole just for Congress, Eric Cantor comes riding to the rescue to stop the 220 or so members of both parties in the House who have co-sponsored Rep. Slaughter’s Stop Trading on Insider Knowledge Act (STOCK Act). I wonder why, don’t you?

Well, not really. After all, Cantor already shorted US treasuries during the debt ceiling debate as was well documented by many news outlets including this Dkos diary from June 28, 2011: Eric Cantor shorting the U.S. Treasury market. I don’t think he did that based on a hunch or gut feeling, do you?

Here’s some info on Eric Cantor’s net worth based in his financial disclosure forms. (Source: opensecrets.org)

2010 Net Worth: From $2,893,110 to $8,048,999

2009 Net Worth: From $2,175,157 to $7,533,999

2008 Net Worth: From $1,853,155 to $6,707,999

Seems like he’s been doing pretty well for himself since the economy cratered in 2008. I know I lost most of my savings, so why is Cantor doing so well these past 3 years? Could it have anything to do with insider trading? Maybe we should ask him. So Mr. Cantor, how much have you profited from the use of inside information in your investments while you have been a member of Congress? Inquiring minds want to know.